Welcome to the Rate My Portfolio megathread! This is the perfect place to share your portfolio and receive valuable insights from the community, helping you gain a fresh perspective.

To make the most out of this experience, please provide as much information as possible about your portfolio.

Remember, let’s keep the community clean and respectful by refraining from downvoting posts simply because you disagree. Instead, let’s encourage upvoting comments that contribute to the discussion.

I’ve switched to CIBC so I’ll be using InvestorEdge. It would be great if thehbhsd some discount on ETF purchases but since they don’t I’ll be setting up an automated purchsse of e-series mutual funds and continue buying crypto ETFs with Wealth-Simple.

Portfolio is boring… 50% S&P e-series 50% International e-series

Currently holding GME and AAPL equally

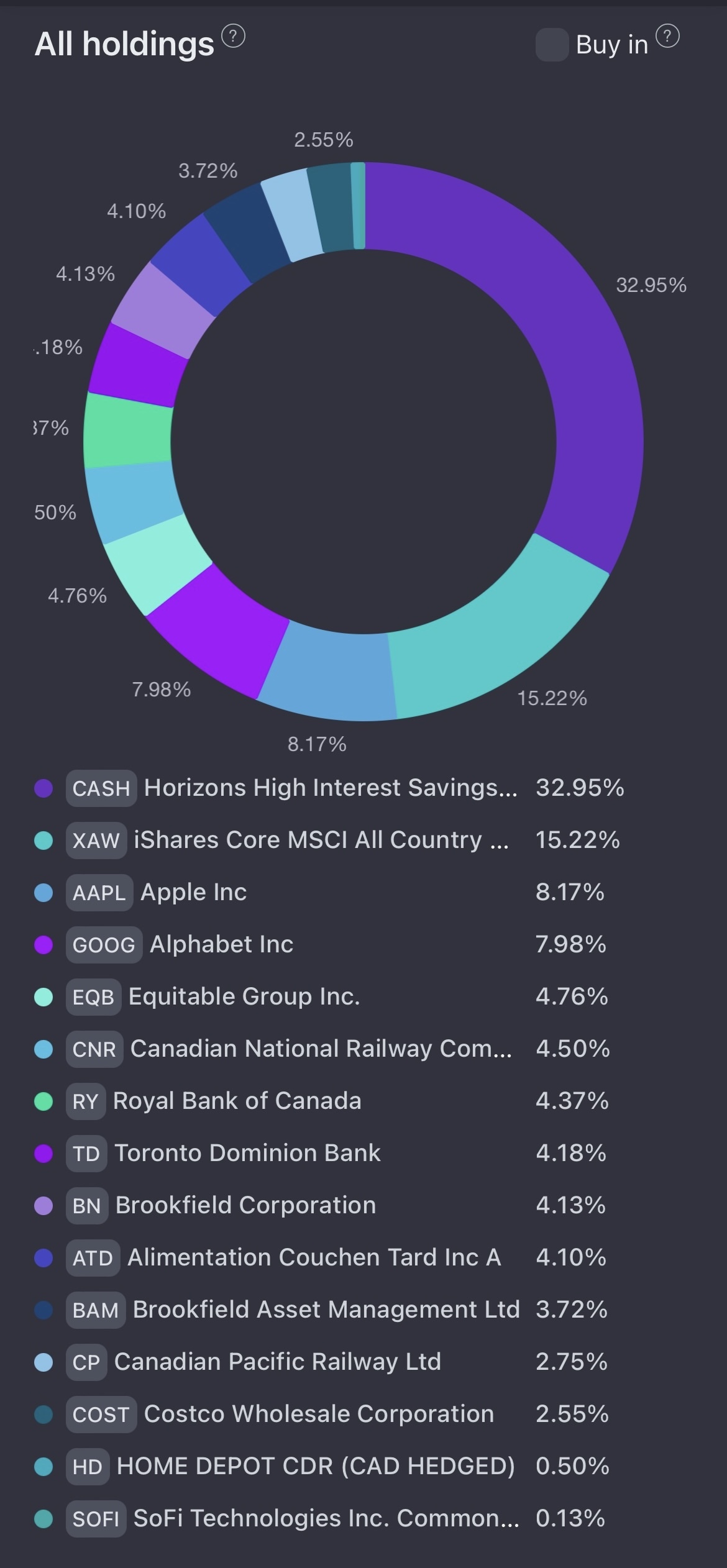

In my mid-30s, I have maximized my contributions to my TFSA and I am currently focusing on maximizing my RRSP this year. Additionally, I have invested some funds in an unregistered account.

I currently hold a significant amount of cash in $CASH.TO as I am saving up to purchase my first property.

Looking ahead, my long-term objective is to engage in dollar cost averaging by investing in $XAW.TO every two weeks over the next 20-25 years.